Do you want to know what it takes to be successful in the commodity options market? Are you looking for an accessible, comprehensive guide so you can learn how to evaluate and capitalise on this incredibly lucrative trading opportunity? Well, look no further.

This article will review the fundamentals of investing in commodities options. You’ll gain insight into where and when to make trades and get a handle on core terminology–all while learning the basics of risk assessment so that your investments come with as much reward as possible. So, take advantage of all the info you need about getting involved in today’s commodity options game.

What is the commodity options market, and how does it work?

The commodity options market is an intriguing form of trading that allows investors to benefit from the potential of price movements in various financial products, from agricultural commodities such as wheat, corn, and soybeans to metals like copper and silver. The key feature of the commodity options market is its ability to enable investors to assume unseen levels of risk—or potential reward—as prices fluctuate over time.

It is accomplished by buying or selling call or put options, which allow traders to benefit from upswings or downturns in the underlying asset’s price within a predetermined length of time. As with most investment strategies, there are risks and rewards when it comes to the commodity options markets, meaning that investors need to carefully consider their choices before diving headlong into this one-of-a-kind trading platform.

The benefits of trading commodities options

What are the benefits of trading options? There are many advantages to trading in this market, some of which include the following:

Low investment costs: Commodities trading does not require large amounts of capital. Instead, trading options can be done with relatively small sums, and any losses would be proportionally smaller.

Ability to diversify investments: By trading individually on multiple commodities, investors can create diverse portfolios that protect against overall market volatility.

Flexibility: Compared to other trading instruments, commodity options offer flexible expiry dates and times that provide increased control over when trades take place and when earnings can be realised.

How to get started in the commodity options market

Getting started trading commodities options can seem intimidating, and however, like any other trading opportunity, it just takes some practice and education to become a successful trader. Here are a few tips to help you get started:

The first step is to choose the commodities you’d like to trade. A wise trading strategy is to diversify your investments, so consider trading in multiple assets and products that match your trading style.

Next, familiarise yourself with trading terminology and understand how the market works by researching different trading strategies. Talk to experienced traders or consult a financial advisor for further guidance.

Finally, start trading. With proper risk management and an understanding of trading fundamentals, you can start trading on paper before going “live” with real money. It will help you get comfortable with different trading scenarios while limiting potential losses.

Tips for success in the commodity options market

The commodity options market can be a volatile and risky trading environment. But there are ways to manage risk and increase your chances of trading success. Here are some tips for trading commodities options:

Understand the markets: Research the different types of commodities, and learn about their trends, seasonality, and vital economic drivers. Understanding these factors will help you make informed trading decisions.

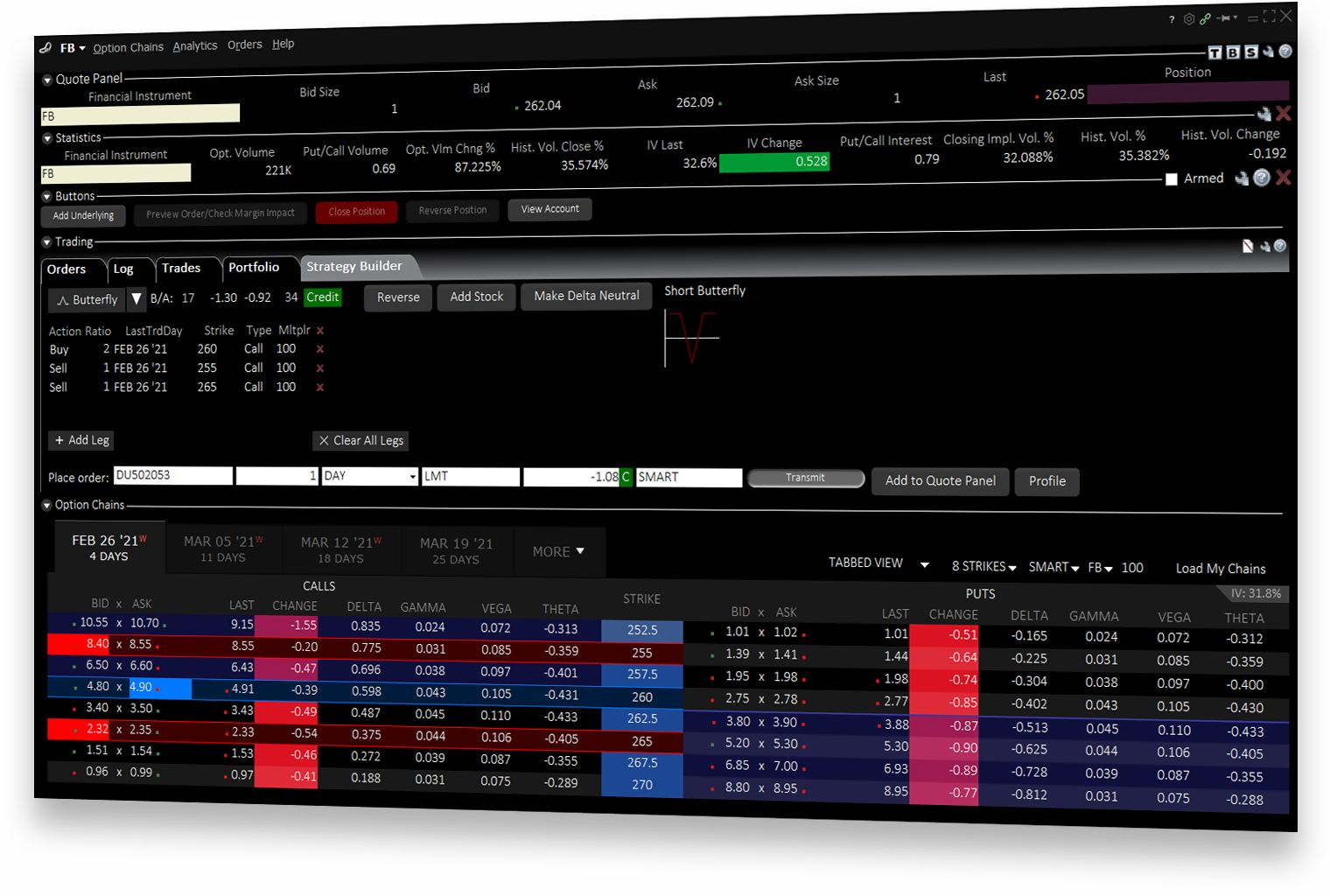

Use trading tools: Make use of trading software such as price alerts and chart analysis to understand price movements in the market better.

Be patient: Only jump into trades after first assessing the risks. Take your time to review market data before making an investment decision, especially with long-term positions that require more patience before earnings can be realised.

Manage risk: Ensure you understand the trading strategies and use appropriate stop-loss orders to protect your trading capital.

The risks associated with trading commodities options

Of course, trading commodities options carries certain risks that all traders should know. These include:

The main risk is the potential for a significant loss of capital. As with all types of trading, there is no guarantee that you will do well, and any losses can be substantial. The markets are susceptible to sudden price changes due to geopolitical events or unexpected economic data releases, which could cause your investments to suffer losses.

Trading strategies may only sometimes work as expected if market conditions have changed since they were developed. It requires traders to stay on top of their strategies and adjust them accordingly if needed.

Conclusion

The commodity options market offers an exciting opportunity for investors to diversify their portfolios and capitalise on price movements in different commodities worldwide. With careful consideration, research, and risk management, anyone can increase their chances of success in this market.