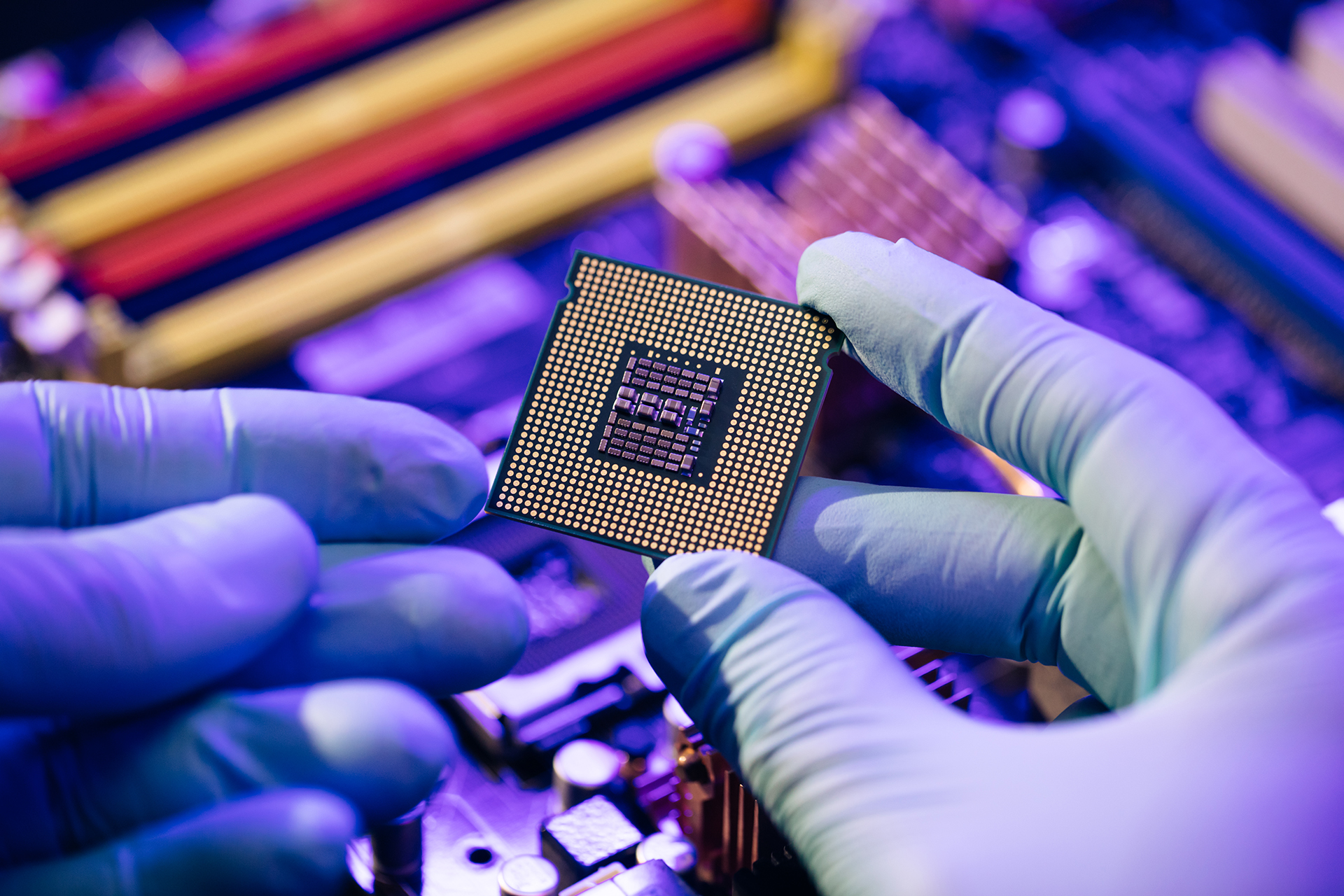

Semiconductors are the building blocks of modern technology, powering everything from smartphones and data centers to renewable energy systems. Yet the supply chains that produce them are highly resource-intensive, generating significant waste and relying on fragile, globalized networks. As sustainability becomes a defining priority, the industry is turning to circular economy models and frameworks designed to minimize waste, extend lifecycles, and close material loops. Erik Hosler, a specialist in advanced semiconductor process control, acknowledges that precision technologies are reshaping the ability to reduce defects and optimize production, laying the foundation for circularity in chipmaking.

The circular economy offers semiconductor companies a way to balance performance with responsibility. By integrating recycling, refurbishment, and lifecycle extension practices, the industry can reduce dependence on scarce resources, cut emissions, and build resilience against supply chain shocks. Exploring how these models apply to semiconductors reveals both their transformative potential and the challenges that must be overcome.

Linear vs. Circular Supply Chains

The traditional semiconductor supply chain follows a linear model: extract raw materials, manufacture chips, distribute products, and discard waste. This approach has supported decades of growth but comes at significant environmental and economic costs. Rare materials are often lost at the end of their life, and defective outputs during production consume enormous resources without creating value.

A circular supply chain flips this model by designing waste out of the system. Materials are reused, products are refurbished, and recycling technologies return critical inputs to the beginning of the chain. For semiconductors, it means rethinking everything from wafer production to end-of-life electronics management.

Recycling and Material Recovery

Recycling is a cornerstone of circularity. In semiconductors, it focuses on recovering valuable elements from both manufacturing scrap and discarded devices. Silicon wafers, rare earth metals, and high-value compounds like gallium and indium can all be extracted and reused.

Urban mining, recovering materials from e-waste, is a key enabler here. By treating discarded electronics as resource reservoirs, manufacturers can reduce reliance on new mining. Advanced separation, chemical extraction, and precision imaging technologies are making it possible to recover materials at near-semiconductor grade purity, a requirement for reuse in fabs.

While recycling infrastructure is still developing, investment in closed-loop recovery systems is growing, particularly in regions like the EU and Japan, where regulations incentivize circular practices.

Refurbishment and Equipment Reuse

Semiconductor fabs themselves offer opportunities for circularity. Tools and equipment represent enormous capital investments, and extending their lifecycles reduces both financial and environmental costs. Refurbishing older equipment for use in mature-node production has become a customary practice, particularly as demand for legacy chips in automotive and industrial markets remains strong.

Refurbished tools not only reduce waste but also ease supply chain pressures during global equipment shortages. By extending the life of capital assets, companies align operational efficiency with circular economy principles.

Extended Product Lifecycles

Circularity also applies downstream in how chips are used. Extending product lifecycles through modular designs, repairability, and software updates reduces demand for constant new production. For consumer electronics, it means devices that can be repaired rather than discarded. For industrial systems, it means designing components that remain viable for decades.

This shift requires collaboration across the value chain. Manufacturers, designers, and customers must prioritize durability and repairability alongside performance. Policy frameworks like right-to-repair laws are also accelerating this shift, nudging companies toward more circular design philosophies.

Precision and Waste Reduction

The success of circular models in semiconductors hinges on the ability to reduce defects and waste at every stage of the value chain. High yields and efficient processes are essential for closing material loops.

Erik Hosler notes, “The ability to detect and measure nanoscale defects with such precision will reshape semiconductor manufacturing. These technologies can enable higher yields, improved quality control, and faster ramp to yield, which in turn reduces costs.” His insight connects directly to circular economy goals: by minimizing defective outputs, manufacturers reduce wasted resources and improve overall sustainability.

It highlights that circularity is not only about recycling at end-of-life but also about precision and efficiency at the point of production. Each defect avoided is a step toward a more sustainable supply chain.

Digital Tools Enabling Circularity

Digital technologies are critical enablers of circular semiconductor supply chains. Learning AI and machine learning optimizes process efficiency, reducing waste in real time. Digital twins allow fabs to model and refine processes virtually, avoiding trial-and-error on physical wafers. Blockchain systems create transparent records of material flows, enabling traceability and accountability across the value chain.

Together, these tools provide the visibility and precision required to build circular systems. They make sure that resources are tracked, waste is minimized, and recovery opportunities are identified early.

Case Studies of Circular Practices

- Intel’s Closed-Loop Water System: Intel has pioneered circular water management, recycling billions of gallons annually within its fabs. It reduces strain on local water supplies while demonstrating how circular models extend beyond materials to all resources.

- TSMC’s Material Reclamation: TSMC has invested in reclaiming chemicals and slurries used in wafer polishing and etching, reducing dependence on virgin inputs. These initiatives support both cost efficiency and sustainability.

- Samsung’s Recycling Programs: Samsung has implemented global take-back programs for consumer electronics, recovering valuable components and materials for reuse in both chips and devices.

These examples show that circular models are not theoretical. They are already reshaping industry practices.

Challenges in Building Circular Supply Chains

Despite progress, challenges remain. Achieving semiconductor-grade purity from recycled materials is technically demanding and often costly. Supply chain complexity makes it challenging to coordinate circular practices across multiple stakeholders.

Cultural and economic barriers also persist. Many customers and manufacturers still prioritize performance and speed over repairability or recyclability. Shifting these priorities will require education, incentives, and regulatory support.

Closing the Loop in Semiconductor Supply Chains

Circular economy models offer semiconductor manufacturers a way to align technological progress with sustainability and resilience. By focusing on recycling, refurbishment, and extended lifecycles, companies can reduce waste, lower emissions, and mitigate resource risks.

Efficiency and sustainability are not competing priorities but complementary forces. Precision in defect detection, innovations in recycling, and collaboration across value chains all support the transition to circularity. For the semiconductor industry, closing the loop is not only an environmental imperative but also a strategic necessity, ensuring that supply chains remain strong, adaptable, and aligned with the demands of a sustainable future.